Home Appraisals Come Under More Scrutiny!

By: Marcie Geffner of Bankrate.com

Homebuyers and sellers who expect an appraisal to sail through to closing without a hitch may be surprised to discover that home appraisals today can be problematic. The reasons for the change are complex, but there's no question that mortgage lenders have started to demand more reviews and do-overs.

Rob Johnson, vice president of lending at San Diego Funding, a mortgage company in San Diego, attributes the increase in home appraisal reviews to lender-specific requirements imposed because of past problems with certain types of home loans. For example, a mortgage lender might demand more scrutiny of an appraisal if the borrower has a marginal credit score or high debt level relative to income or if the property was a foreclosure that was fixed up and flipped by an investor.

Appraisals may lag home prices

Home prices are also a factor. When prices are on the rise, perhaps because buyers have bid more in a multiple-offer situation, appraised values might still be lower. The reverse is also the case.

"Any time you have a market in transition, appraisals aren't going to keep up because the appraisal is based on historical data," Johnson says.

Inadequate "comps" can present problems as well. ("Comps" are recent sales of nearby homes that are similar, or comparable, to the home that's the subject of the appraisal.) The mortgage lender may deem the comps inadequate if the homes were too far away or were sold in such nontraditional circumstances as a short sale or foreclosure or if the sales occurred too long ago. If the comps aren't sufficient, the lender may order a review or second home appraisal to verify that they were chosen correctly.

"If (the appraiser) can't find three comps within that area and has to expand, that is where you start to get appraisal reviews or secondary appraisal requirements to make sure the appraisal was valid or that (the lender) was comfortable," Johnson says.

The term "second appraisal" generally refers to a new, start-from-scratch valuation. An appraisal review could be a "desk review," in which the appraisal gets a second look by an office-bound person, or a "field review," in which the appraisal is subject to another drive-by or in-person inspection of the property. A review is more common than a second appraisal.

New guidelines distance lenders from appraisers

Leslie Sellers, president of the Appraisal Institute in Chicago, says a lender might order a new home appraisal if the first one was based on factual errors or the appraiser wasn't competent in the area.

Some second appraisals, he adds, result from a misunderstanding of the Home Valuation Code of Conduct, guidelines that were meant to prevent undue pressure being placed on appraisers to inflate home valuations, but that may have caused some lenders to cut off communication with appraisers."The banks are thinking they can't even talk to the appraiser," he says.

Sellers can offer comps to appraiser

An appraisal review can cost several hundred dollars while a second appraisal generally involves a second full fee, says Sara Schwarzentraub, owner of Inter-State Appraisal Service in San Diego. These costs usually are paid by the buyer.

"It's commendable that the lenders are being cautious and having stricter criteria to protect themselves, because in the long term that protects everybody, but it does make it more costly," she says.

Home sellers can offer the appraiser information that might affect the appraiser's opinion of the home's value. This information is best handed over before the appraisal is prepared. "If you know of a sale that's similar to your house and it was a foreclosure, short sale, divorce or anything of that nature, make the appraiser aware of that," Sellers says.

Real-estate brokers can help buyers and sellers find comps to offer the appraiser, Johnson says. If the broker believes comps may present a problem, the buyer and seller can plan accordingly. "A good real-estate agent is aware of these issues. Many times, an agent will call us and say, 'I know we are going to have problems with comps on this," he says.

Buyers and sellers also can agree on longer time frames for the home appraisal contingency and closing date. Schwarzentraub says that asking for a 45- or 60-day closing, rather than 30 days, is not unreasonable.

Buyers are entitled by federal law to a copy of any appraisal for which they've paid a fee. Buyers should look over the appraisal and notify the lender of any errors that could have affected the appraiser's opinion of the home's value.

What This Means for Stephens & Stephens and You

For Our Sellers: We are always brutally honest with our sellers about values. We pledge to always tell you upfront what we expect your house to sell for and to back it up with comps from the area. This helps avoid any shock when the appraisal comes in. Rebekah and I always tell our sellers that we have to sell the house twice, the first time to the buyer, and the second to the appraiser (meaning we have to make them see the value in the home too). We rarely run into appraisal issues because of this, but every once it awhile it still happens. When it does, we do our best to show the appraiser where we are coming from and provide additional comps or information on the home.

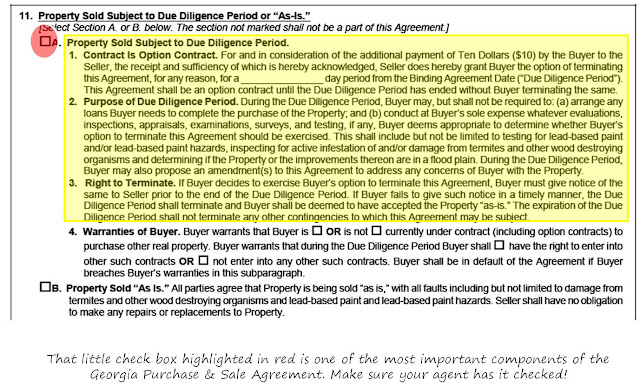

For Our Buyers: Before our buyers place an offer on any home, we'll show you a Comparative Market Analysis (CMA) on the neighborhood or area to show you what homes are selling for. After reviewing it with the buyer, we'll help make a decision about a fair offer price. The comps we review are likely the same comps an appraiser will look at, therefore we already kind of know what the comparisons are going to be. If the comps don't support the seller's asking price, then obviously we advise our buyers to offer less and back it up by showing the comps. We also add protection for our buyers by adding an "Appraisal Contingency" clause, meaning the house must appraise for the contract price or you'll have the right to renegotiate or walk away.